When a company makes a big fee that covers a number of months, it might be thought of a remeasurement of the Lease Liability and ROU Asset and must be accounted for as such. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and advisor for greater than 25 years and has built monetary models for all sorts of industries. If you don’t use the rental property as a house and you’re renting to make a profit, your deductible rental bills can be more than your gross rental earnings, topic to certain limits. For information on these limitations, discuss with Publication 925, Passive Exercise and At-Risk Rules and Matter no. 425. Moreover, businesses can customise approval workflows to control spending, guaranteeing that only licensed personnel can make prepayments or adjustments.

This can embrace bills like insurance coverage premiums that are paid upfront but not but used. Prepaid expenses, like insurance, hire, and promoting, are paid prematurely however the expense exhibits up on future revenue statements. Pay As You Go bills, however, are bills that have been paid prematurely but not yet used. For example, should you pay for a year’s price of insurance premiums upfront, the complete amount is taken into account a prepaid expense until the insurance is used. To further illustrate the evaluation of transactions and their effects on the basic accounting equation, we are going to analyze the actions of Metro Courier, Inc., a fictitious corporation.

The Generally Accepted Accounting Ideas matching precept prevents expenses from being recorded on the revenue statement before they incur. As an organization realizes its prices, it transfers them from property on the balance sheet to expenses on the revenue statement, lowering the bottom line. Pay As You Go expenses are transferred from property to expenses on the earnings statement when the benefit is realized, reducing net income. This is in distinction to deferred expenses, which are recorded as an expense on the income statement as they’re incurred. To decide if a transaction is a pay as you go expense, consider the timing and utilization interval of the acquisition.

- Moreover, the prepayment system allows companies to handle cash move predictability, making it easier to allocate assets for other business needs, improving monetary forecasting and planning.

- For a enterprise proprietor, these changes translate to a clearer understanding of the month-to-month prices and may considerably impression budgeting and financial planning.

- Deferred lease is primarily linked to accounting for operating leases underneath ASC 840.

- Accrued expenses, however, are acknowledged earlier than money is paid, permitting companies to delay cash outflows whereas nonetheless reporting the expense.

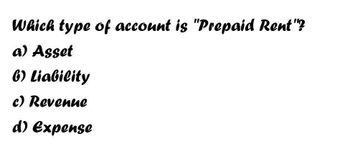

Pay As You Go bills can appear on a stability sheet under the “Current Property” heading, typically grouped with other current assets like cash and accounts receivable. However, not all prepaid bills will seem as current property, as some might https://www.simple-accounting.org/ have corresponding journal entries as long-term, non-current assets. The combined lease expense is now reported within the operating part of the revenue statement under ASC 842 instead of lease expense. Conclusively, prepaid rent is claimed to be a permanent account since it is reported as a current asset on the steadiness sheet.

Accounting For Lease Underneath The New Lease Accounting Requirements

Beneath accrual accounting and GAAP’s matching principle, you document expenses when they’re incurred, not if you pay them. In essence, we’re just delaying the bad information and calling it a ‘matching principle’. Cash or the honest market worth of property or companies you obtain for the use of real property or personal property is taxable to you as rental revenue. Volopay’s pay as you go playing cards offer the pliability to pay vendors globally utilizing Visa or Mastercard-backed cards, expanding fee capabilities beyond native borders.

By following these steps, companies can preserve accurate and transparent monetary data, which is crucial for informed decision-making and maintaining belief with stakeholders. To illustrate, consider an organization that signs a lease agreement the place the owner requires the primary and final month’s hire as a deposit. If the monthly lease is $2,000, the corporate will document a pay as you go expense of $4,000. This quantity won’t be expensed till the company occupies the house in the first and last months of the lease term.

Each prepaid bills and deferred expenses are important features of the accounting process for a business. Understanding the difference between prepaid expenses and deferred expenses is essential for correct monetary reporting. A firm makes a cash fee, however the lease expense has not yet been incurred so the company has prepaid rent to report. Pay As You Go rent is an asset – the pay as you go amount can be used by the entity in the future to scale back rent expense when incurred in the future. The periodic lease expense for an operating lease underneath ASC 842 is the product of the entire money payments due for a lease contract divided by the total variety of intervals within the lease time period.

Obtain Our Final Lease Accounting Information For More Examples:

For the examine to reach the owner and publish by the primary, the group writes the verify the week before on the twenty fifth. When the verify is written on the twenty fifth, the interval for which it’s paying has not occurred. Due To This Fact the check is recorded to a prepaid lease account for the timeframe of the twenty fifth through the top of the month. On the first day of the following month, the period the rent check was meant for, the prepaid lease asset is reclassed to lease expense. Both lease expense and lease expense represent the periodic fee made for the use of the underlying asset.

With modern financial tools like Volopay’s prepaid playing cards, small businesses can automate and monitor pay as you go transactions with ease. These playing cards permit you to allocate particular budgets for recurring bills and supply real-time expense tracking. This not only simplifies recordkeeping but also minimizes human error and reduces reconciliation time. The entry for the ROU asset is a debit to Lease Expense for $33,469 and a credit to Right-of-use (ROU) Asset for the same amount to record the amortization.

As you can see, pay as you go bills can differ significantly by way of the upfront cost and monthly expense. It Is important to accurately record and account for these bills to ensure correct monetary reporting. A pay as you go expense is created when a company pays for something prematurely, similar to insurance coverage, rent, or taxes. For example, if an organization pays its landlord $30,000 in December for rent from January via June, the pay as you go expense account is listed on the steadiness sheet as a present asset.

Prepaid rent is classed as a present asset on the balance sheet, because it represents a future financial profit that shall be consumed inside the subsequent yr. This classification allows businesses to account for lease expenses in a systematic and orderly manner, matching the price of renting the space with the interval during which it is utilized. In distinction, accrued expenses are recorded after the cost has been incurred however earlier than fee is made.